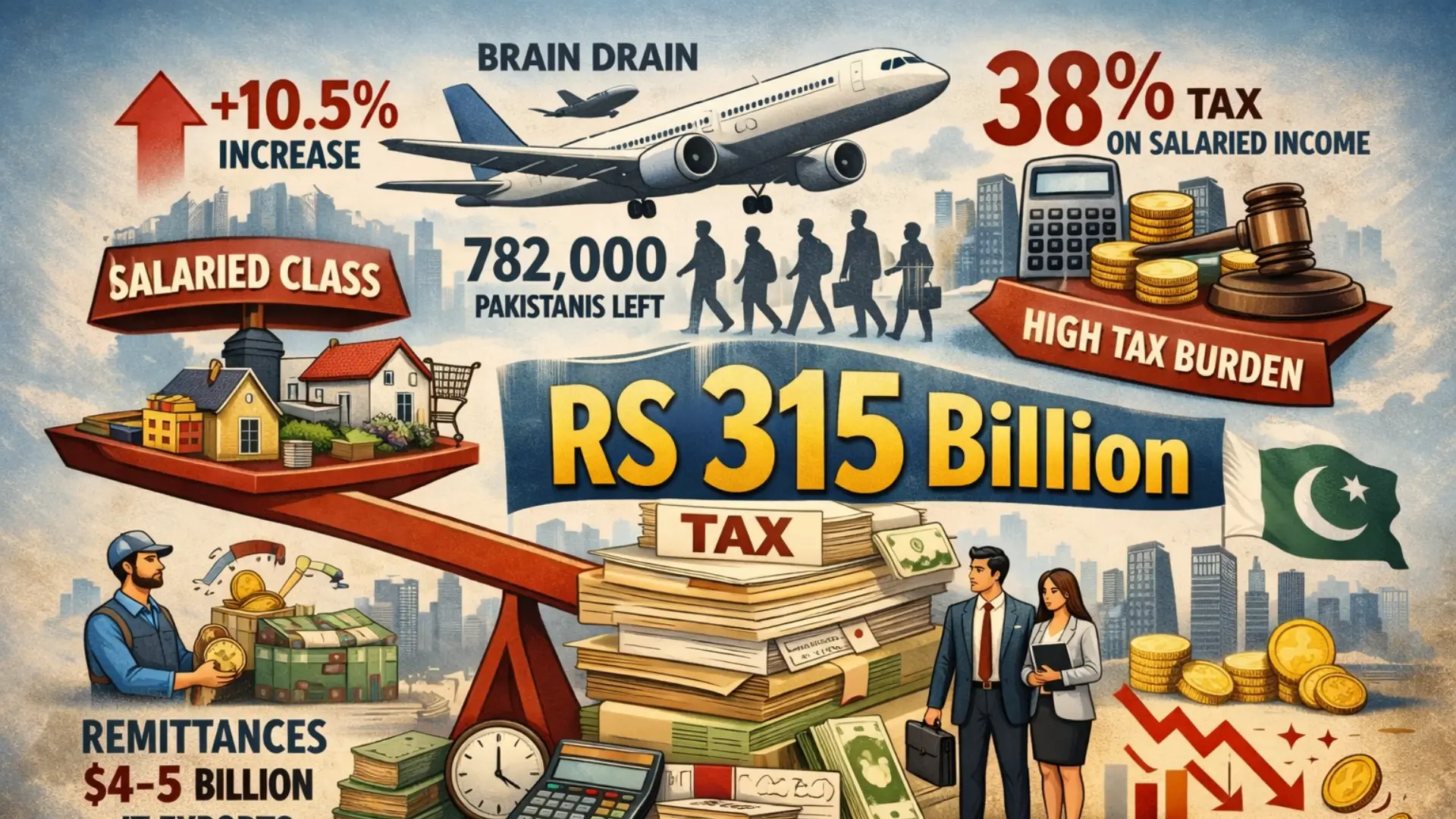

Salaried Class Pays Rs. 315 Billion. Pakistan’s salaried class has once again emerged as the biggest contributor to direct taxes, paying Rs. 315 billion in income tax during the first seven months of fiscal year 2025–26. The figure reflects a 10.5 percent increase compared to the same period last year, highlighting the growing tax pressure on fixed-income earners at a time when skilled professionals continue to leave the country.

The latest provisional data compiled by the Federal Board of Revenue (FBR) shows that income tax paid by salaried individuals rose from Rs. 285 billion in July–January FY25 to Rs. 315 billion in July–January FY26, marking an increase of Rs. 30 billion.

This sharp rise has renewed debate over Pakistan’s tax structure, fairness in tax collection, and the long-term economic impact of over-reliance on the salaried class.

Salaried Class Bears a Disproportionate Burden

Despite representing a relatively small share of Pakistan’s population, salaried individuals continue to shoulder a disproportionately large share of income tax. Data shows that the amount collected from salaried employees in both public and private sectors was more than double the tax collected from the real estate sector during the same period.

The reported Rs. 315 billion does not include book adjustments or income tax paid by certain contractual employees under Section 153-B of the Income Tax Ordinance, according to sources familiar with the data. Even without these adjustments, the salaried segment remains the most heavily taxed group.

Experts argue that instead of expanding the tax net to include under-taxed sectors, the government continues to rely on the same documented taxpayers, mainly salaried professionals whose taxes are deducted at source and are difficult to evade.

Effective Tax Rate Reaches 38 Percent

One of the most concerning aspects is the effective tax rate faced by salaried individuals. On average, salaried employees pay around 38 percent of their gross income in direct taxes. This rate is significantly higher than that paid by comparable income groups in neighboring countries.

In contrast, sectors such as real estate, retail, and wholesale trade continue to contribute far less relative to their economic size. Analysts believe this imbalance discourages formal employment and pushes professionals to explore opportunities abroad.

Rising Taxes and Accelerating Brain Drain

The heavy tax burden has coincided with a sharp rise in brain drain, particularly among skilled and highly qualified professionals.

According to official figures from the Bureau of Immigration and Overseas Employment, around 762,000 Pakistanis left the country last year. Out of these, 254,180 were categorized as skilled, highly skilled, or highly qualified individuals.

The breakdown shows:

- 222,171 skilled workers

- 13,657 highly skilled professionals

- 18,352 highly qualified individuals

The exodus included 5,659 chartered accountants and 3,795 doctors, raising serious concerns about Pakistan’s future human capital and service sectors.

Remittances Keep Economy Afloat

Economic analysts warn that Pakistan has avoided default largely due to remittances sent by overseas Pakistanis, many of whom left in search of better pay and lower tax regimes.

While remittances have provided short-term relief, other key indicators remain weak. Exports declined by 7 percent during the first seven months of FY26, while foreign direct investment (FDI) fell by 47 percent in the first half of the fiscal year.

This combination of falling exports, shrinking investment, and rising emigration presents a serious challenge for long-term economic stability.

Government Rejects Large-Scale Exodus Claims

The government, however, disputes claims that skilled professionals are leaving Pakistan in large numbers. Speaking during a meeting of the Senate Standing Committee on Finance, Finance Minister Muhammad Aurangzeb said that Pakistan earns $4–5 billion annually from IT exports, indicating that many skilled workers continue to operate from within the country.

He acknowledged public concerns but argued that digital exports and freelance income show that talent retention is not as weak as portrayed.

Limited Relief Under IMF Constraints

The finance minister highlighted that income tax for individuals earning Rs. 100,000 per month was reduced from 5 percent to 1 percent. However, he admitted that meaningful relief for higher-income salaried individuals could not be provided due to restrictions under Pakistan’s agreement with the International Monetary Fund (IMF).

These limitations have left the government with little room to ease the burden on documented taxpayers, even as inflation and living costs continue to rise.

Sector-Wise Breakdown of Salaried Tax Payments

Detailed data shows notable differences across employment categories:

Non-corporate sector employees paid the highest amount, contributing Rs. 139 billion, a 14 percent year-on-year increase. Corporate sector employees paid Rs. 100 billion, reflecting a 16 percent rise compared to last year.

Provincial government employees contributed Rs. 44 billion, showing an 8 percent decline, while federal government employees paid Rs. 31.5 billion, up 9 percent from the previous year.

The figures suggest stronger compliance in private employment compared to the public sector.

Tax on Wealthy Pensioners Falls Short

The government also introduced a new tax on wealthy pensioners, applying to retirees under 70 years of age with annual pensions exceeding Rs. 10 million. However, the measure generated only Rs. 30 million during the first seven months of FY26.

This minimal contribution highlights the limited fiscal impact of the pension tax and raises questions about its effectiveness as a revenue-generating tool.

FBR Struggles to Broaden the Tax Base

Despite repeated commitments, the FBR has struggled to sustain reforms aimed at broadening the tax base. Several enforcement measures were reportedly rolled back due to political and business pressure.

FBR Chairman Rashid Langrial recently told the Senate committee that influential individuals were obstructing tax enforcement and promised to identify those responsible. However, critics argue that meaningful reform remains elusive.

Real Estate Sector: Mixed Tax Trends

The real estate sector experienced mixed results. Withholding tax on plot sales rose 63 percent to Rs. 106 billion, while tax on plot purchases fell 29 percent to Rs. 47 billion after the government reduced buyer-side rates.

Overall, the government collected Rs. 152 billion in withholding taxes from real estate during 7MFY26, representing a 17 percent increase compared to last year. Despite this growth, collections remain far below those from salaried individuals.

Conclusion

Pakistan’s salaried class continues to bear the heaviest tax burden, paying Rs. 315 billion in just seven months. Without meaningful tax reforms and broader documentation, rising taxation risks accelerating brain drain, weakening productivity, and undermining long-term economic growth despite short-term revenue gains.