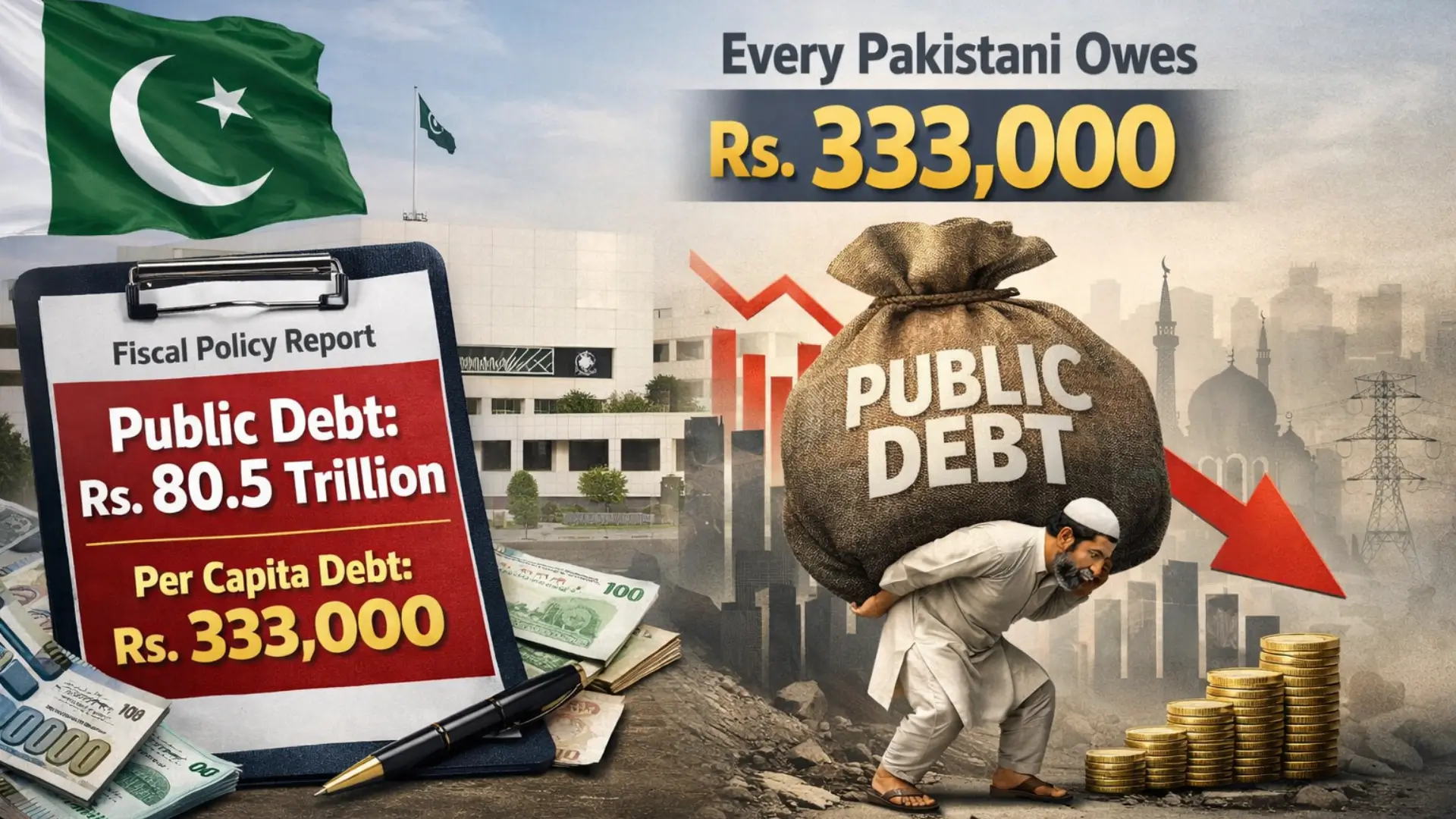

Every Pakistani Owes Rs. 333,000 as Public Debt. Pakistan’s public debt has reached a worrying level. According to the latest Fiscal Policy Statement, every Pakistani now carries an average debt burden of around Rs. 333,000. This figure shows how fast the country’s debt is growing and why it has become a serious economic challenge.

The Ministry of Finance shared these details in its annual report presented to Parliament. The data highlights rising government borrowing, higher interest payments, and pressure on the national economy. For ordinary citizens, this growing debt directly affects daily life through inflation, taxes, and reduced public services

What Is Per Capita Public Debt?

Per capita public debt means the total government debt divided by the total population. Think of it like this. Imagine a large family that takes a big loan. Even if only the parents borrow money, every family member feels the pressure. In the same way, when a country borrows, the burden spreads across all citizens.

In fiscal year 2024–25, Pakistan’s per capita debt increased from Rs. 294,098 to Rs. 333,041. This is a jump of nearly Rs. 39,000 per person in just one year. The calculation is based on an estimated population of 241.5 million people.

This sharp rise shows that government spending and borrowing grew faster than income and economic growth.

Pakistan Total Public Debt Crosses Rs. 80.5 Trillion

Pakistan’s total public debt rose from Rs. 71.2 trillion in June 2024 to Rs. 80.5 trillion by June 2025. This means the country added more than Rs. 9 trillion in new debt within a single year.

The Ministry of Finance explained that the main reason for this increase was higher interest payments. The government borrowed more money to meet its expenses, even beyond the limits set by law. When borrowing increases, interest costs also rise, creating a cycle that is hard to break.

Why Interest Payments Are a Big Problem

Interest payment is the money the government pays just to service existing loans. It is like paying monthly interest on a credit card without reducing the original bill.

In Pakistan’s case, interest payments consume a very large share of government revenue. This leaves less money for schools, hospitals, roads, and job creation. Even when the government tries to cut development spending, interest payments remain unavoidable.

The report admitted that public debt dynamics remained a key challenge. Changes in interest rates and exchange rates made the situation worse, pushing debt levels higher.

Debt as a Percentage of GDP Keeps Rising

Another important indicator is public debt compared to gross domestic product (GDP). GDP is the total value of goods and services produced in a country. It is like a household’s monthly income.

Pakistan’s public debt increased from 67.6 percent of GDP in June 2024 to 70.7 percent by June 2025. This means the country owes much more than what it earns in a year.

A higher debt-to-GDP ratio signals financial stress. It also reduces investor confidence and limits the government’s ability to respond to economic shocks.

Fiscal Deficit Exceeds Legal Limits

Fiscal deficit happens when government spending is higher than its income. During fiscal year 2024–25, Pakistan’s federal fiscal deficit reached 6.2 percent of GDP.

This was far above the legal limit of 3.5 percent, set under the Fiscal Responsibility and Debt Limitation Act. In simple words, the government spent around Rs. 3.1 trillion more than what the law allows.

This overspending increased borrowing needs and added further pressure on public debt.

First Full Year of the Current Government

Fiscal year 2024–25 was the first complete financial year of the government led by Prime Minister Shehbaz Sharif, who took office in April 2024.

Despite repeated claims of fiscal discipline, official data shows that spending remained high and borrowing continued. The gap between promises and actual performance became visible in the rising deficit and debt figures.

Government Spending Breakdown

The federal government had budgeted Rs. 18.9 trillion in total expenditure for the year. This included Rs. 17.2 trillion for current spending, such as salaries, pensions, subsidies, and interest payments.

Actual current expenditure stood at Rs. 15.8 trillion, slightly lower than the budget. The main reason was that interest payments remained below initial estimates due to a reduction in the policy interest rate during the year.

Interest Payments Still Take the Largest Share

Even after lower utilization, interest payments reached Rs. 8.8 trillion, compared to a budgeted Rs. 9.8 trillion. This means about 91 percent of the allocated amount was used.

This single expense consumed a massive portion of government resources. It highlights how debt servicing has become the biggest obstacle to economic stability.

Defense and Development Spending

Defense expenditure exceeded expectations. Actual defense spending reached nearly Rs. 2.2 trillion, compared to the budgeted Rs. 2.1 trillion.

On the other hand, development spending suffered. Development expenditure, including net lending, was budgeted at Rs. 1.7 trillion, but actual spending remained at Rs. 1.4 trillion. This is around 84 percent of the allocation.

Lower development spending means fewer infrastructure projects, fewer jobs, and slower long-term growth.

Subsidies and Pension Payments

Government subsidies totaled Rs. 1.3 trillion, slightly below the budgeted Rs. 1.36 trillion. These subsidies are often used to control energy prices and support vulnerable groups.

Pension payments reached Rs. 911 billion, compared to an allocation of Rs. 1 trillion. Rising pension costs are another long-term pressure on government finances.

Tax Collection Falls Short of Target

On the revenue side, tax collection reached Rs. 11.7 trillion, against a target of Rs. 13 trillion. This means the government achieved only 90.5 percent of its tax goal.

Lower tax collection forces the government to borrow more. It also shows weaknesses in the tax system, including narrow tax base and enforcement issues.

Non-Tax Revenue Provides Some Relief

Non-tax revenue performed better than expected. It rose to Rs. 5.1 trillion, which is 104 percent of the budgeted amount.

This improvement came mainly from higher profits transferred by the State Bank of Pakistan and stronger collections from the petroleum levy. These gains helped partially offset the shortfall in tax revenue.

Consolidated Fiscal Deficit Slightly Lower

The Ministry of Finance said the overall fiscal position improved due to provincial cash surpluses, central bank profits, and petroleum levy receipts.

As a result, the consolidated fiscal deficit, which includes provincial accounts, was limited to 5.4 percent of GDP. This was lower than the budgeted 5.9 percent, offering slight relief.

However, experts warn that this improvement is still not enough to reverse the long-term debt trend.

What This Means for Ordinary Pakistanis

For everyday citizens, rising public debt means higher inflation, more taxes, and fewer public services. It also reduces job opportunities and slows economic growth.

Using a simple example, if a household keeps borrowing to cover daily expenses, it eventually struggles to pay school fees, medical bills, and utility costs. Pakistan faces a similar situation at the national level.

Conclusion

The jump in per capita public debt to Rs. 333,000 reflects deep-rooted fiscal problems. While some indicators improved slightly, overall debt levels continue to rise. Addressing this issue requires tough decisions, consistent policies, and long-term planning to protect Pakistan’s economic future.